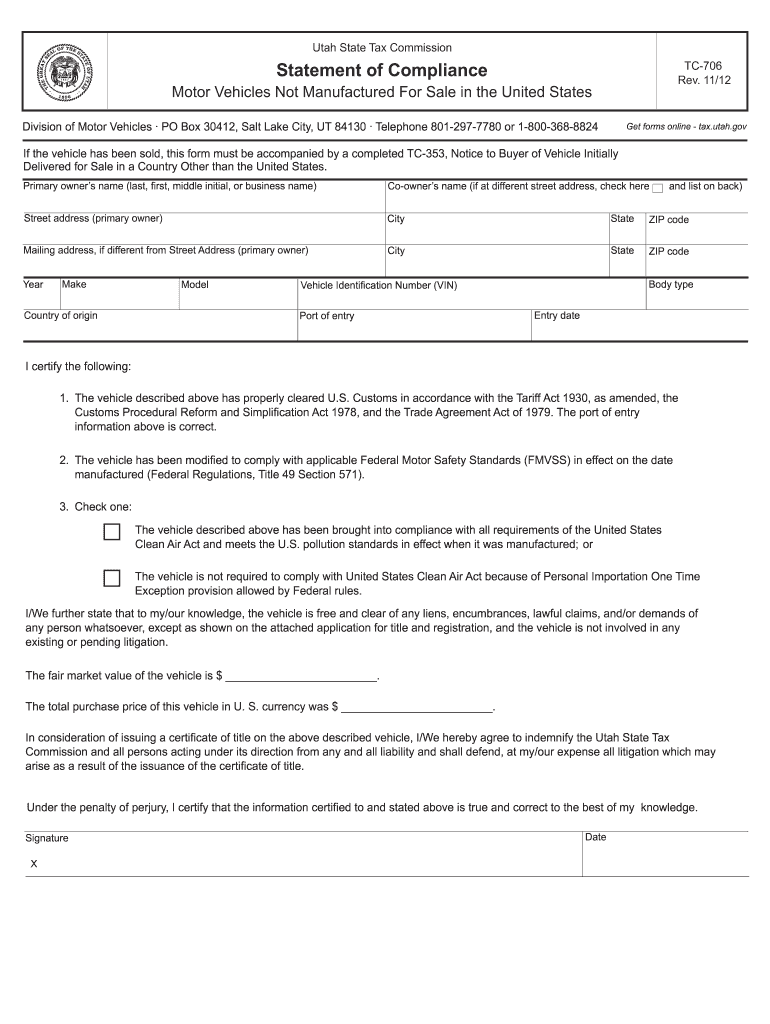

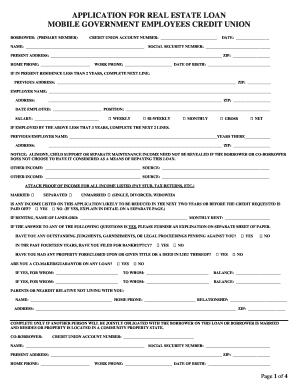

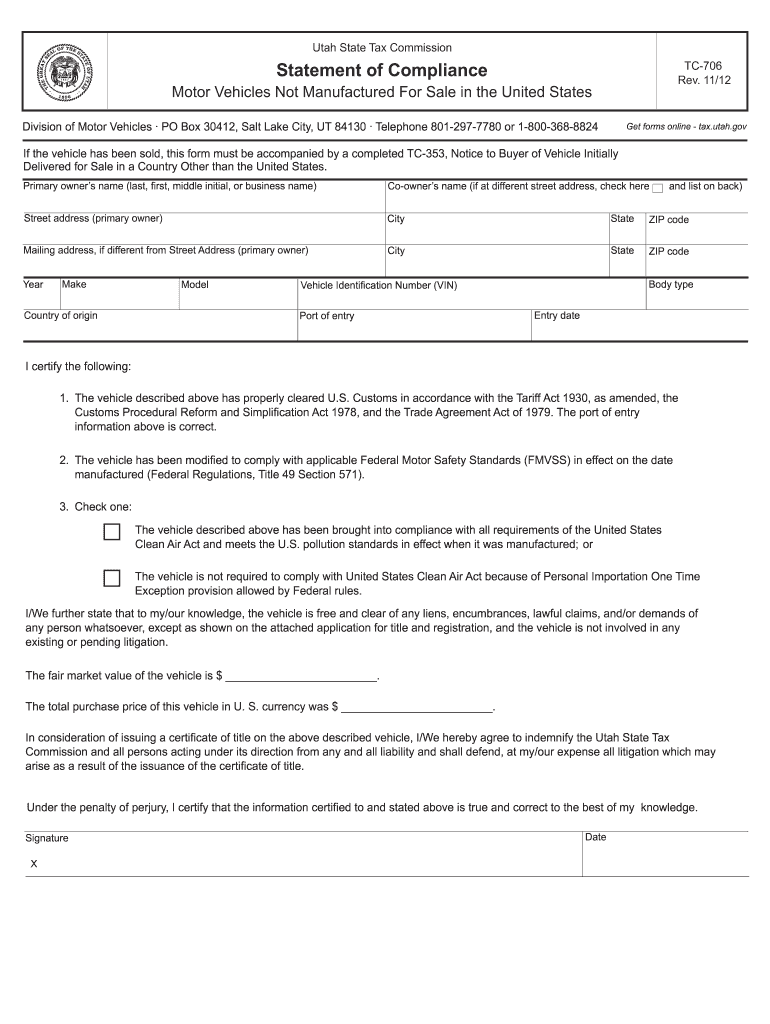

UT USTC TC-706 2012-2025 free printable template

Get, Create, Make and Sign state statement 706 form

How to edit tax 706 motor online

How to fill out tax tc 706 make form

How to fill out UT USTC TC-706

Who needs UT USTC TC-706?

Video instructions and help with filling out and completing form compliance 706

Instructions and Help about statement 706 motor fill

Hi my name is Rachel we're going to talk about how to evaluate the hydraulic system on your tractor maybe if the tractor has been studying in an estate for a while, and you go to use it the hydraulics don't work the three-point doesn't go up and down and this is an easy technique that will save you a lot of grief so that you can get the part on hydraulic pump so the very first thing that you want to evaluate just pull the dipstick out of your hydraulic reservoir and make sure that it does indeed have clean hydraulic oil in it doesn't have water in or anything like that if you discover that yours doesn't go ahead and add some hydraulic oil in there because that will be essential to your hydraulics working properly the next thing that you'll want to do is use a blow-off nozzle this one that has a point on it is a good type to use inside your hair toilet pump here we're going to blow some pressure into the reservoir and this will make that hydraulic oil that's in the reservoir come up into the pump so that you can get a perm on your hydraulic pump, so I'll start the tractor up I'll put it down roll a little item I'll put the pressure in the pump until the hydraulics work, and then we'll talk when you are working out a tractor that does indeed have dry like issue you will definitely need to blow pressure in their longer you might need to blow for up to a minute just keep testing that hydraulics until that works and then when you are done when your hydraulics work make sure you don't pull that blow off my little eye there right away because you'll have pressure in the hydraulic oil coming up on yours you don't want to happen when you are putting pressure in there and the oil is moving from the reservoir to the pump you might notice that it's leaking somewhere might leak somewhere within the lines it might leak up here which would show that you have a crack within your hydraulic pump and that will help you diagnose where you need to work on the hydraulic system however ninety percent of the time this trip by putting that pressure in your reservoir will indeed fix your hydraulic problems this technique will work on any tractor that has an external hydraulic pump the tractor that I'm demonstrating on has a piston type pump this will work on a vein pump as well, so it's definitely a technique that will work for many tractors and help you get those hydraulics working

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send utah tax 706 pdf to be eSigned by others?

How can I get utah 706 forms form?

How do I complete utah compliance vehicles on an iOS device?

What is UT USTC TC-706?

Who is required to file UT USTC TC-706?

How to fill out UT USTC TC-706?

What is the purpose of UT USTC TC-706?

What information must be reported on UT USTC TC-706?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.